Misfuelling: What to Do When You Fill Your Car with the Wrong Fuel

Visit this page

Car Shows and Motoring Events in 2024

Visit this page

Drink Drive Limits and the Law

Visit this page

Electric Car Servicing: A Comprehensive Guide to Keeping Your EV in Optimal Condition

Visit this page

A Step-by-Step Guide on How to Change a Tyre

Visit this page

What to Do If You Have a Cracked Windscreen

Visit this page

Safety Features to Look For In a Leased Vehicle

Visit this page

Clean Your Car’s Interior Like A Pro

Visit this page

Get the Lowest Car Insurance Rates in Group 1

Visit this page

How to Clean Your Car Like A Pro

Visit this page

What You Need to Know About Car Insurance Groups

Visit this page

Check If Your Car Is Insured

Visit this page

Car Tax Check For Free

Visit this page

How To Drive Safely in Windy Weather

Visit this page

Car Shows and Motoring Events in 2023

Visit this page

Car Road Tax Rates Explained

Visit this page

Car Audio Systems: A Comprehensive Guide

Visit this page

Guide to HEVs: Hybrid Electric Vehicles

Visit this page

Guide to PHEVs: Plug-In Hybrid Electric Vehicles

Visit this page

Telematics Insurance Explained

Visit this page

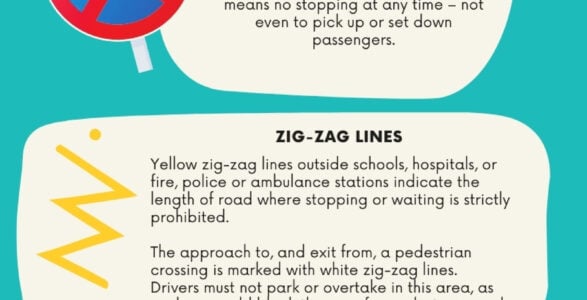

Parking Dos and Don’ts (Infographic)

Visit this page

E10 Fuel Explained

Visit this page

How to Check Your Engine Oil (Infographic)

Visit this page

How to Check Your Tyre Pressure (Infographic)

Visit this page

The Essentials of Charging an Electric Vehicle (Infographic)

Visit this page

Drive Safely in The Snow and Ice (Infographic)

Visit this page

Breakdown Cover Explained

Visit this page

Winter Driving: The Ultimate Guide to Driving in Snow and Ice

Visit this page

Guide to Charging an Electric Car

Visit this page

Driving in Europe Checklist

Visit this page

How to Check Your Tyre Pressure

Visit this page

Create Your Own Winter Car Kit

Visit this page

How to Check Your Tyre Tread

Visit this page

How to Drive Safely in Wet Weather

Visit this page

A Guide to Dash Cams

Visit this page

How to Check and Top Up Your Car’s Engine Oil

Visit this page

What To Do If Your Car Breaks Down

Visit this page

How To Prevent Your Car From Being Stolen

Visit this page

The Pros and Cons of Manual vs Automatic Cars

Visit this page

Guide to Branding Your Business Vehicle

Visit this page

A Guide to Tyre Repair Kits

Visit this page

Everything you Need to Know About Servicing Your Car

Visit this page

How to Keep Cool on Road Trips in Hot Weather

Visit this page

The Costs of Running a Car

Visit this page

Games to Play on Car Journeys

Visit this page

Essential Guide to Child Car Seats

Visit this page

Mobile Phones, Driving and the Law

Visit this page

How to Cut Your Fuel Costs

Visit this page

Ultra Low Emission Zone (ULEZ) Explained

Visit this page

How to Choose the Best Family Car

Visit this page

Catalytic Converter Crime

Visit this page

Fixed Penalty Notices Explained

Visit this page

Car Valeting Tips

Visit this page

How to Reduce the Cost of Motoring

Visit this page

Car Insurance Terminology

Visit this page

Neighbour Parking Conflicts and Disputes

Visit this page

The Safest Cars According to NCAP

Visit this page

Throwing litter is rubbish!

Visit this page

Cats Eyes and Road safety

Visit this page

UK Race Tracks

Visit this page

Car Travel With Your Dog

Visit this page

Road Rage and How to Avoid It

Visit this page

Scenic Driving Routes in Ireland

Visit this page

Car Sharing To Save Money

Visit this page

Beaulieu National Motor Museum

Visit this page

Speeding Laws in the UK

Visit this page

Women Drivers – the Safest Motorists on UK Roads

Visit this page

Drug Driving Laws

Visit this page

A Guide to Fuel Cards, Loyalty Cards and Cash Back Credit Cards

Visit this page

Drive More Efficiently and Save Money

Visit this page

Bald Tyres: Warning Signs, Risks, Causes and Prevention

Visit this page

Scenic Driving in Wales

Visit this page

How to Get The Best Car Insurance Deals

Visit this page

How To Find The Best Fuel Prices

Visit this page

Tyre Blowout: Causes, Prevention and How to Handle

Visit this page

MOTs: Everything You Need To Know

Visit this page

Electric Car Charging Stations Guide

Visit this page

Guide To Driving In Fog

Visit this page

Vehicle Breakdowns: How To Avoid Them

Visit this page

Guide to Jump Starting Your Car

Visit this page

Potholes – A Driver’s Nightmare

Visit this page

Car Theft Prevention

Visit this page

Middle Lane Hogging

Visit this page

A Guide To Electric Cars

Visit this page

Cars With The Best In-Car Entertainment

Visit this page

Keeping Kids Entertained on Long Journeys

Visit this page

Guide To Car Headlight Bulbs: Halogen, Xenon and LED

Visit this page

Motorway Breakdown Tips

Visit this page

How to Drive Safely Around Cyclists

Visit this page

Build Your Brand Reputation With Your Fleet Vehicles

Visit this page

Winter Tyres: How They Work and When To Use Them

Visit this page

How to De-Ice Your Windscreen

Visit this page

Black Boxes: Preventing Dodgy Car Insurance Claims

Visit this page